Nonprofit organizations, like all businesses, need to be financially sustainable in order to thrive. Doing so while serving a community and delivering on a mission requires diligent leadership that is tuned into the organization’s financial model.

Financial models at nonprofit organizations are not static. The composition of revenue, expenses, and investment evolves as the organization matures and responds to external events and strategic internal decisions. Organizations survive and flourish by contracting, changing, growing, and changing again. So financial models are not a “set it and forget it” situation.

Nonprofit leaders constantly find themselves considering proactive and reactive changes to their financial model. This article will help you develop a resilient approach to navigating these changes.

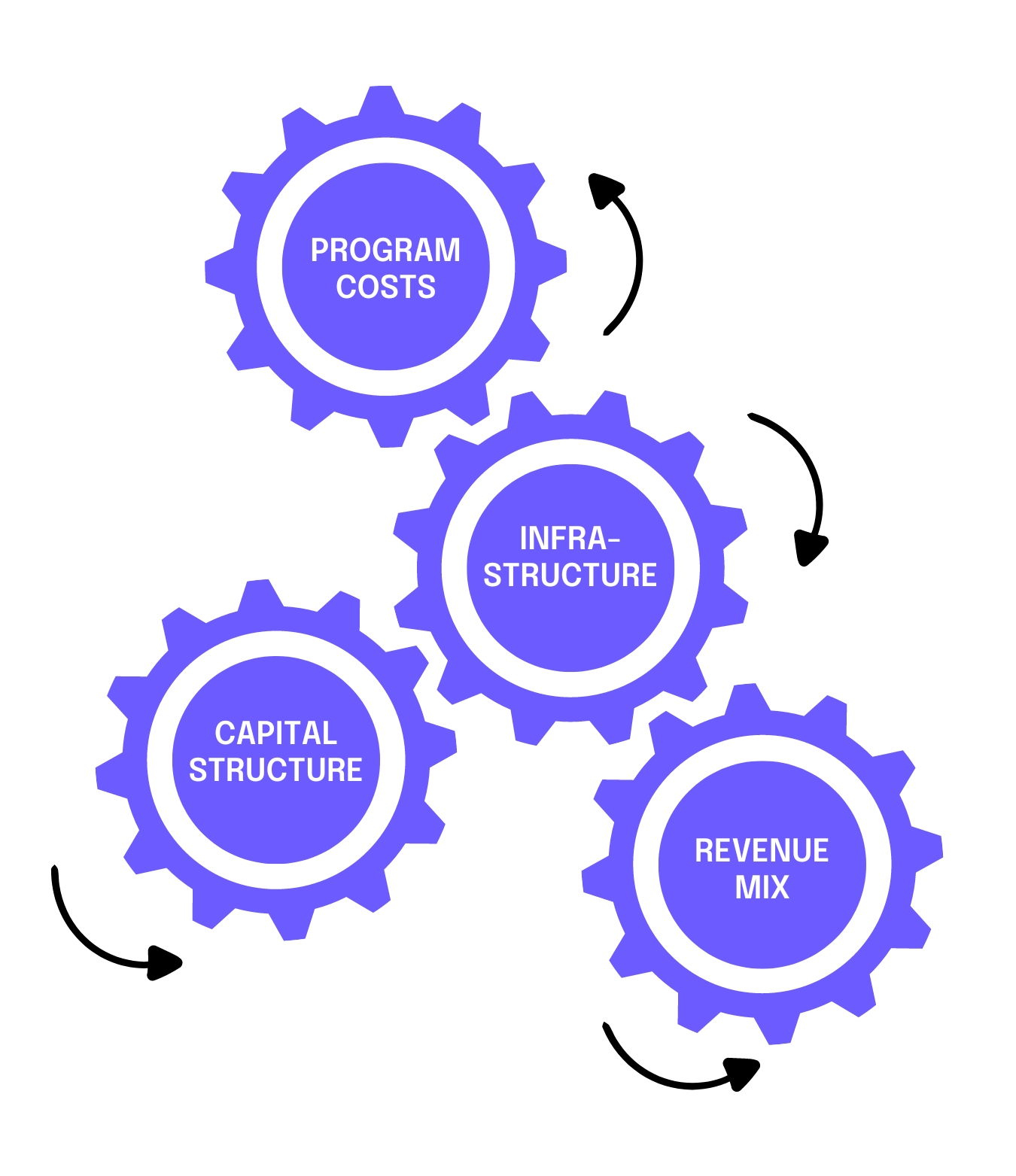

Moving through the gears

The financial structure of nonprofits contains four core components:

- Revenue mix

- Infrastructure

- Program costs

- Capital structure

Together they make up the financial model that sustains the business entity and creates value for the community. The four components are closely interrelated, so that each is impacted by changes to any of the other three. Think of them like a set of gears: if you move one, the others move as well.

Revenue Mix

Most nonprofits have one or two dominant sources of revenue, supplemented by one or two secondary sources. The value of revenue diversification for nonprofits is a time-honored assumption! However, different types of revenue offer different benefits and requirements and necessitate different types of infrastructure. For example, government contracts, individual donors, and foundation grants all rely on different expertise, technologies, and relationships. Revenue grows as you develop reliable systems and relationships within those sources.

Infrastructure

Stable and effective governance, management, and fundraising are essential for the long-term health of an arts organization. The expenses required to maintain this vital infrastructure, however, such as costs for administrative payroll and facilities, are often targeted for reduction to preserve program services which is why every expense area needs thorough review to seek different ways of accomplishing your goals.

One of the most common discussions is around changes to staff roles because personnel costs typically account for more than half of all expenses. The solution isn’t necessarily to reduce staff or salaries but could be to identify new or different positions. Taking a hard look at your operation and seeking ways to change the expense structure while maintaining vital infrastructure results in a more sustainable financial model.

True Program Costs

Acknowledging the true cost of delivering programs enables nonprofits to make informed decisions and clear choices about the value and priority of their portfolio of services. The true cost of programs goes beyond the direct costs that are normally attributed to the program. Allocations for shared costs such as facilities, technology, administrative office expenses, and communications are also included when calculating true program costs, which shows how critical this core mission support is to the success of nonprofit organizations.

The true costs of your programs may be very different from the costs stated in contracts and agreements, and they are often much higher than the prices paid by third parties or funders. Your organization subsidizes the difference between cost and price using contributions, general operating funds, earned income, or reserves. How to fund these subsidies is one of a nonprofit’s most important financial decisions and is best made intentionally based on mission, impact, and strategy.

Capital

Capital, the wealth available to nonprofits for investment and growth, is accumulated incrementally through fundraising, capital campaigns for buildings and endowments, and operating surpluses in the good years. Arts organizations have overlooked capital for years, paying little attention to net assets on their balance sheets. A healthy capital structure creates the capacity to make strategic investments in advancements such as new fundraising initiatives, program development, or branding and marketing. Capital also provides:

- Stability, in the form of cash flow for emergency reserves

- Resilience, in the form of operating or opportunity reserves

- Durability, in the form of building reserves or endowments

Managing change through your financial model

As change occurs in and around your organization, your financial model may need to adapt to it. Before developing a plan to change your financial model, it’s important to assess the current condition of each of its components. This process consists of four steps:

-

1

Analyze

Analyze the components of your financial model to make sure you understand it.

-

2

Assess

Realistically assess external economic factors and past internal decisions and leadership actions to diagnose any critical weaknesses in the model or identify anticipated internal or external changes that will affect the organization.

-

3

Forecast

Forecast and plan a structure that will address the weaknesses and be effective in the short and midterm future.

-

4

Implement

Implement any necessary changes suggested by your planning and forecasting.

In making this assessment, organizations must decide why and when to change their business model and the scope of change that is needed. For example:

- Do you simply need to refine or tweak the model to accommodate the change?

- Do you have time to prepare for the anticipated changes, or is there an urgent need for an overhaul?

- Do you need to make incremental tactical changes to buy the time needed to develop more strategic solutions for the future?

Taking the time to find answers to these questions will help you take actionable and realistic next steps toward building a financial plan.

Building a three-year financial plan

All organizations develop an annual budget, but a three-year financial plan allows you to be much more strategic in your planning for financial model changes. Here’s a step-by-step process outlining the basics:

-

1

Predict

Predict your annual expenses for the next three years. Will they be about the same, somewhat larger, significantly larger?

-

2

Identify

Identify the factors that drive the predictions, as well as the expense areas affected.

-

3

List

List the components of your current situation: largest revenue components and the infrastructure needed to generate the revenue.

-

4

Decide

Decide if a change is needed in any component of your financial model to accomplish your goals in three years, determining how the anticipated changes will affect your largest income components and their required infrastructure three years into the future.

-

5

Describe

Describe what is needed to accomplish those changes in the next three years. You will use this to set goals.

See it in action

As an example of how to rethink your financial model, let’s consider a hypothetical Dance Company. The Dance Company’s primary source of revenue comes from selling tickets to their beautifully produced live events. They have an effective marketing strategy for their performances that is well-implemented and results in generally full houses. Their second biggest resource is an in-kind donation of rehearsal space that they receive each year. They also receive a few grants, and while it’s only a small amount of their revenue, they reliably collect about 300 small individual donations each year from their patron community.

Over the next 3 years, the Dance Company wants to build operating reserves and to rent an additional space that will allow them to expand their programming. Including the cost of a new space, they expect this will increase their annual operating expenses by 20%, or $60,000. Using the three-year financial plan, they need to analyze their revenue mix to determine how they could best hope to increase revenue by $60,000 per year. Will each piece of the pie grow by 20%, or will some pieces need to grow more?

The answer to this question depends upon their ability to grow or develop the necessary supporting infrastructure, as well as the measure of reliability and autonomy these revenue sources offer. For example, they are not able to increase the value of their in-kind donated space (currently 17% of their annual revenue), but they clearly excel at marketing and retaining small donors. Perhaps those communication skills and relationships would be effective areas to invest in, to support growing their revenue.

Try it for yourself

Are you feeling inspired? It’s time to try it out using our worksheet. For your convenience, the worksheet is available as a PDF.

Resources used in developing this tool:

- Propel Nonprofits: An Executive Director’s Guide to Financial Leadership

- Propel Nonprofits: True Program Costs: Program Budget and Allocation Template and Resource

- Propel Nonprofits: A Graphic Re-visioning of Nonprofit Overhead

- Propel Nonprofits: Transforming Nonprofit Business Models

- Propel Nonprofits: Transforming Business Models Primer Video